MI UIA 1028 2014-2025 free printable template

Show details

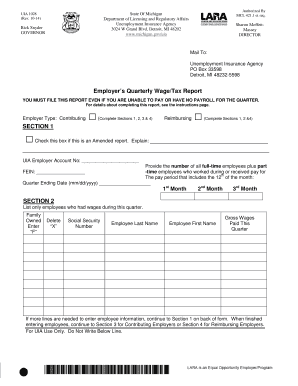

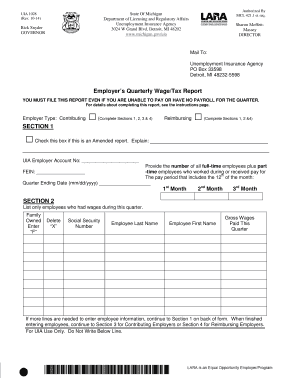

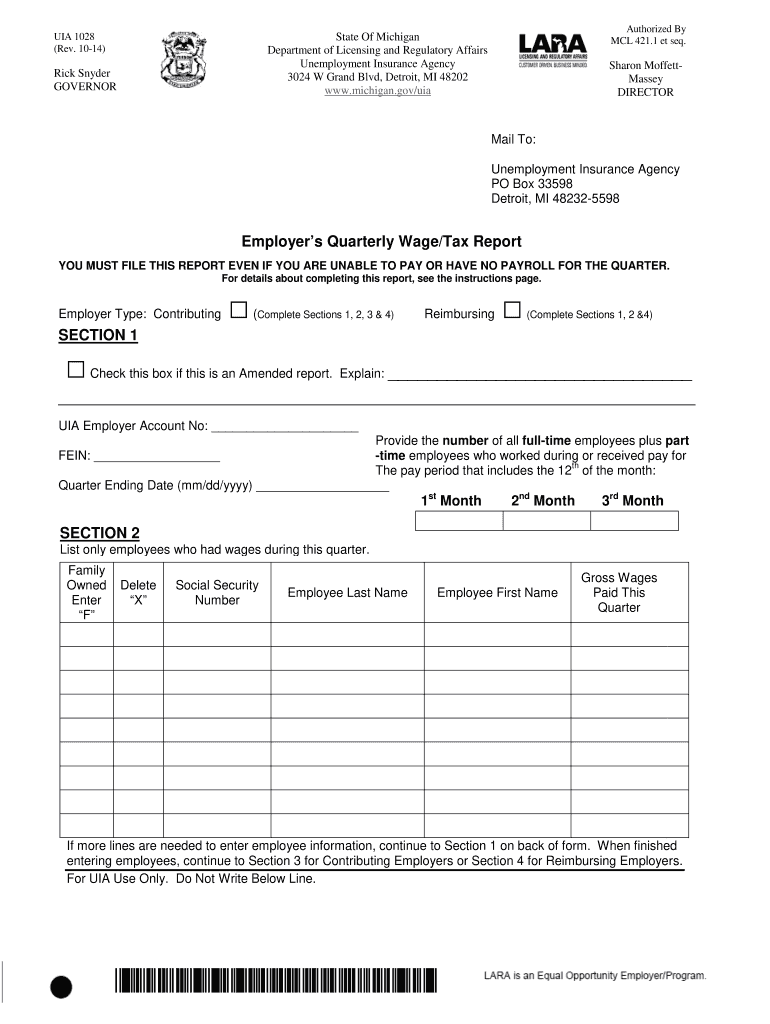

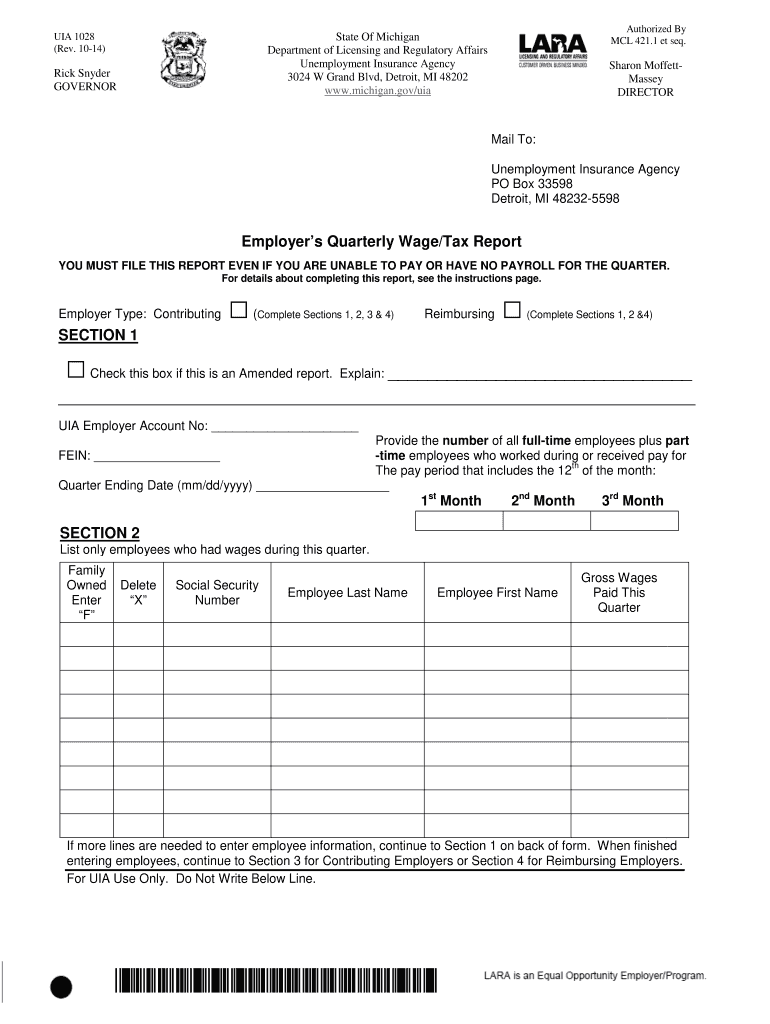

Michigan.gov/uia UIA 1028 Rev. 10-14 Rick Snyder GOVERNOR Sharon MoffettMassey DIRECTOR Mail To PO Box 33598 Detroit MI 48232-5598 Employer s Quarterly Wage/Tax Report YOU MUST FILE THIS REPORT EVEN IF YOU ARE UNABLE TO PAY OR HAVE NO PAYROLL FOR THE QUARTER. For details about completing this report see the instructions page. We encourage you to log on to WWW.Michigan.gov/UIA to create your MiWAM account. PENALTY/INTEREST CHARGES FOR LATE FILING OF THIS REPORT For All Employers A penalty of...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign mi uia form 1028

Edit your uia 1028 printable form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your uia 1028 michigan form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit michigan unemployment forms online online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit michigan quarterly wage tax report form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MI UIA 1028 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out uia 1028 form

How to fill out MI UIA 1028

01

Download the MI UIA 1028 form from the official website.

02

Fill in your personal information at the top, including your name, address, and Social Security number.

03

Indicate the reason for filing the form in the designated section.

04

Provide details of your employment history, including names of employers and dates of employment.

05

Attach any required documentation, such as proof of income or work separation.

06

Review the entire form for accuracy and completeness.

07

Sign and date the form at the bottom.

08

Submit the form via mail or through the designated online portal.

Who needs MI UIA 1028?

01

Individuals who are applying for unemployment benefits in Michigan.

02

Workers who have been laid off, terminated, or experienced a reduction in hours.

03

Those who are seeking compensation for loss of wages due to unemployment.

Fill

uia form 1028

: Try Risk Free

What is uia 1028?

Form UIA 1028, Employer's Quarterly Wage/Tax Report

Wage detail information must be provided for every covered employee to whom wages were paid during the calendar quarter. This form is mailed about 30 days before the completed form is due back to UIA.

People Also Ask about michigan unemployment forms pdf

What is the purpose of a separation notice?

An employee separation agreement is a legal document that lays out an understanding between a company and a terminated employee. After both parties sign, the terminated employee gives up their right to take legal action against the company in the future (i.e., suing for wrongful termination or severance pay).

Will the state of Michigan refund unemployment tax?

If you qualify and filed a 2020 return without the $10,200 unemployment compensation exclusion, then YES, you will most likely need to file an amended return. For those who are entitled to a refund, you will need to file an amended return in order to receive your refund.

What disqualifies you from unemployment in michigan?

If you lost your job because of misconduct at work (such as violating workplace rules or failing to show up regularly), you may not qualify for unemployment compensation. Being fired does not automatically disqualify you—you can still receive unemployment payments if you were fired for having poor job performance.

Do I have to pay taxes on the extra $600 from unemployment in Michigan?

For a Michigan resident, any unemployment benefits (including the extra weekly $600 received through the CARES Act) that are included in federal adjusted gross income are subject to tax in Michigan.

What does it mean when michigan unemployment says misrepresentation?

The person committing fraud could be a claimant who is intentionally misrepresenting information being provided to the Unemployment Insurance Agency (UIA) when filing and/or certifying for unemployment benefits or could be a traditional fraud matter whereby a criminal is impersonating or representing themselves as a

Is michigan waiving taxes on unemployment?

Unemployment benefits are taxable, so payments received in 2022 must be reported on state and federal tax returns. Anyone who received jobless benefits this year will receive Form 1099-G Certain Government Payments as proof of income and how much income tax was withheld this year.

Do you have to pay taxes on unemployment in Michigan?

Unemployment benefits are taxable, so any unemployment compensation received during the year must be reported on federal tax return. If you received unemployment benefits in 2022, you will receive Form 1099-G Certain Government Payments.

Is a separation letter the same as a termination letter?

When a company ends an employee's job, they typically provide a termination letter, also called a letter of separation, stating the reason for termination and next steps. A termination letter is an official and professional way to document and describe the separation between the employee and employer.

Is Michigan waiving unemployment overpayments?

Short-Term Pause on Collection of OverpaymentsTop In late December 2022, Michigan's Unemployment Insurance Agency (UIA) said it would temporarily stop trying to collect overpayments from people who filed for unemployment insurance since March 1, 2020.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send uia 1028 to be eSigned by others?

When you're ready to share your michigan unemployment forms fill, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I complete amended uia 1028 online?

Completing and signing michigan 1028 quarterly report online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How can I fill out mi uia 1028 form on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your forms unemployment michigan. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is MI UIA 1028?

MI UIA 1028 is a form used in Michigan for reporting unemployment insurance information. It is primarily utilized by employers for various reporting purposes related to their employees.

Who is required to file MI UIA 1028?

Employers in Michigan who are subject to unemployment insurance laws are required to file MI UIA 1028. This includes both private sector and nonprofit employers.

How to fill out MI UIA 1028?

To fill out MI UIA 1028, employers should gather relevant employee information, complete the necessary sections of the form, ensuring accurate reporting of wages and hours worked, then submit the form by the required deadline.

What is the purpose of MI UIA 1028?

The purpose of MI UIA 1028 is to allow employers to report wages and provide necessary information to the Michigan Unemployment Insurance Agency for the calculation of unemployment benefits.

What information must be reported on MI UIA 1028?

MI UIA 1028 requires reporting information such as employee names, social security numbers, total wages paid, and the number of weeks worked within the reporting period.

Fill out your MI UIA 1028 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Uia 1028 Mi is not the form you're looking for?Search for another form here.

Keywords relevant to uia 1028 michigan online

Related to state of michigan unemployment forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.